AV Construction Works with The Menke Group to Adopt the Employee Ownership Model with an Employee Stock Ownership Plan (ESOP)

Fountain Valley, CA, April 17, 2024 – The Menke Group, a leading full-service ESOP provider, announced that AV Construction, a renowned healthcare development firm based in Fountain Valley, has become 100 percent employee owned with the help of The Menke Group. The Menke Group will assist AV Construction to extend ownership of the company to…

Contribution and Allocation Limitations

CONTRIBUTION AND ALLOCATION LIMITATIONS FOR PLAN YEARS ENDING IN 2024 Date: April 2024 C CORPORATION CONTRIBUTION LIMITATIONS (Sec. 404 of the Code): Example: (The Sec. 404 limit is calculated for all employer plans in the aggregate.) Sec. 404 Gross Compensation 1 $345,000.00 Less Sec. 401(k) Salary Reduction 0.00 Less Sec. 125 Salary Reduction 0.00 Net…

IRS Releases Retirement Plan Limits for 2024

Listed below are the planned IRS (Internal Revenue Service) cost-of-living Adjustments for 2024. This is a preliminary list applicable to most employer-sponsored retirement plans and the wage base for Social Security. The remainder of the health and welfare plan limits for 2024 are expected to be released by the IRS in the near term. RETIREMENT…

Matrix HG Works with The Menke Group to Adopt the Employee Ownership Model with an Employee Stock Ownership Plan (ESOP)

San Mateo, CA, April 2, 2024 – The Menke Group, a leading full-service ESOP provider, announced that Matrix HG, a Concord-based innovator serving the San Francisco Bay Area with commercial HVAC systems, has become 100 percent employee owned with the help of The Menke Group. The Menke Group will assist Matrix HG to extend ownership…

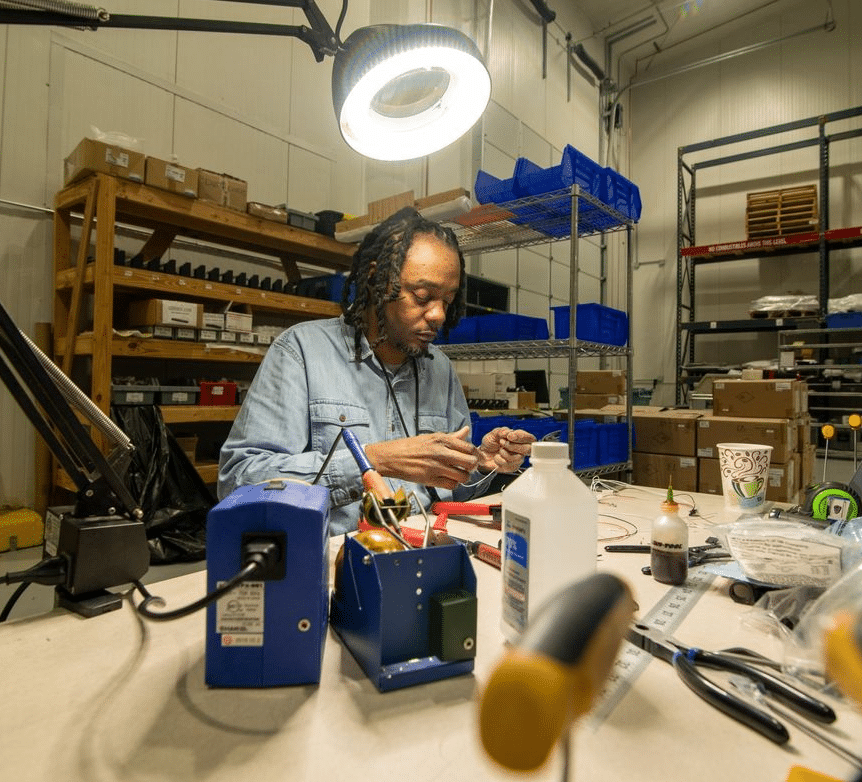

Zepnick Solutions: It starts with an idea.

In 2000, Jody Zepnick, founder of Zepnick Solutions, had an idea. He wanted to create a business that would not only serve a growing niche — manufacturing automation — but would also be a place that people want to work for. Fast forward 24 years, Zepnick has provided engineering solutions and equipment for automation to…

Brown Construction Works with Menke to Become 100% Employee-Owned with an Employee Stock Ownership Plan (ESOP)

San Mateo, CA, March 12, 2024 – The Menke Group, a leading full-service ESOP provider, announced that Brown Construction Incorporated, one of the largest general contractors in the greater Sacramento area and ENR Top 400 general contractor, has become 100% employee-owned with the help of The Menke Group. The Menke Group enabled Brown Construction to…

Hyperion Technology Group: A Bright Future in Mississippi

It’s not every day that the Wall Street Journal features one of your clients. The end of 2023 saw that spotlight shine on Menke client Hyperion Technology Group touting it as a success story in an article about Mississippi and the American South. Competitive salaries and benefits burnish Hyperion’s reputation and standing, CEO Geoffrey Carter…

Can ESOPs Expand the Shrinking Pool of Accountants?

As more accountants retire from the profession, they are not being replaced by new practitioners. A recent Wall Street Journal article shone a spotlight on a disturbing trend: the number of college students graduating with a bachelor’s degree in accounting dropped by almost eight percent from the previous year, according to a study by the…

Employee Ownership: Building Resilience and Security

A recent study commissioned by the Employee-Owned S Corporations of America (ESCA) has unveiled a compelling narrative – workers who own their companies through Employee Stock Ownership Plans (ESOPs) enjoy significantly greater employment advantages compared to the broader American workforce. Employee-owned S corporations excel in employee retention, boasting a corporate culture that fosters worker satisfaction.…

Bipartisan Legislation Aims to Streamline S-Corp ESOP Implementation for Businesses

Congress is continuing its support for employee ownership in general and ESOPs in particular with the introduction of bipartisan legislation designed to simplify the process of establishing Employee Stock Ownership Plans (ESOPs) for S-Corps. The Promotion and Expansion of Private Employee Ownership Act aims to address the barriers that have historically hindered S-Corp companies from…

BDO’s Employee Stock Ownership Plan: A Bold Move

When BDO USA’s 880 partners met recently in Florida, they voted nearly unanimously to establish an employee stock ownership plan (ESOP). The plan is scheduled to go into effect on August 31, 2023 and will give the firm’s 10,000 employees a direct stake in ownership. The firm’s executives will continue to lead the company and…

New Employee Ownership Initiative from the US Department of Labor

Employee ownership is a powerful force for financial well-being and Employee Stock Ownership Plans (ESOPs) benefit both business owners and employees. The US Federal government recognized these factors in the 2023 national budget by including support for provisions dedicated to spurring ESOPs and Congress has introduced bi-partisan measures to advance employee ownership. The drumbeat of…

Menke Client Clark-Devon Hardware Highlighted in Chicago Sun Times

A recent Chicago Sun Times article outlined how Menke client Clark-Devon Hardware, a well-established hardware store based in Chicago, has taken a significant step towards empowering its workforce and securing its future by implementing an Employee Stock Ownership Plan (ESOP). By transitioning to employee ownership, Clark-Devon Hardware aims to create a stronger sense of commitment…

New SBA Guidance Enhances Financing Opportunities for ESOPs

Small businesses looking to transition to an employee-owned model through ESOPs can benefit greatly from two recent pieces of regulatory guidance from the Small Business Association (SBA) which bring positive changes to the financing landscape for ESOPs. These important pieces of guidance are Procedural Notice 5000-846607 and SOP 50 10, Version 7, both of which…

Employee Equity Investment Act: Another Boost for a New Decade of Employee Ownership

In recent years, there has been a growing emphasis on promoting employee ownership in the United States. This focus has been championed by Congressional leaders and various states who recognize the numerous benefits that employee ownership can bring to businesses and their workforce. Earlier in 2023, the passage of the WORK and SECURE 2.0 Acts…

Menke Case Study: Kennon Products

Protecting High Value Assets Protecting High Value Assets: this phrase expresses the mission for Kennon Products and the litmus test for decisions on investing the company’s resources. Located in the foothills of the Big Horn Mountains in Sheridan, Wyoming, the company’s ability to innovate and excellence in engineering led to its focus on protecting high…

Private Equity and Employee Ownership: The ESOP Opportunity

A recent article in Middle Market Growth magazine explores a new trend in private equity: investing in companies with employee stock ownership plans (ESOPs). Private equity has traditionally shied away from these companies, seeing ESOPs as an ‘either-or’ proposition. However, private equity investors are looking at ESOPs with fresh eyes. Recent Federal legislation may well…

Kicking Off 2023 with The National Center for Employee Ownership

The Menke Group is looking forward to participating in the 2023 meeting series for the The National Center for Employee Ownership. The meeting series is designed for business owners who are evaluating whether an Employee Stock Ownership Plan (ESOP) is the right vehicle for their business succession needs. The first meeting of 2023, entitled “Is…

US Government Measures to Spur ESOP Adoption

ESOPs are a powerful tool for businesses, as they can help to align the interests of employees with those of the company and can also serve as a means of attracting and retaining top talent. The United States Congress recognized these advantages when they passed the 2023 Omnibus Bill, a comprehensive spending bill that funds…

Department of Defense Pilot Program Encourages Contracting with Employee-Owned Businesses

The Department of Defense (DoD) issued a memorandum on November 8, 2022 of great import for employee-owned government contractors. The memorandum describes a pilot program for S-corporations that are 100% owned by an employee stock ownership plan (ESOP) to receive a noncompetitive award for certain follow-on contracts. This pilot program is especially noteworthy since it…

ESOP Fables at the ASPPA Annual Conference

On October 23, retirement industry professionals will gather in Washington DC for the annual conference of the American Society of Pension Professionals and Actuaries (ASPPA). Menke Group’s CFO and COO, Trevor Gilmore, will address the meeting on the topic of “ESOP Fables: Succeeding with a Powerful Succession Option”. An Employee Stock Ownership Plan (ESOP) is…

ESOP Updates in Hawaii

The Hawaiian Chapter of The ESOP Association is holding its first in-person event of the year on October 20 and the Menke Group will be there! Our Senior Corporate Counsel, Victor Alam, will be making two presentations at the conference in Honolulu: Current Issues Facing ESOP Companies Special Administration Issues Rebalancing, Reshuffling, Recycling, Diversification and…

Phil DeDominicis to present ESOP overview for owners, CFOs & CPAs

Sept 15 / Oct 13 / Nov 17, 2022 — Phil DeDominicis will be presenting a webinar for my-cpe.com where he will give an ESOP overview for owners, CFOs & CPAs. This webinar provides a broad overview of ESOPs, discussing key topics such as using them as a business succession tool, how they are structured and financed, typical scenarios where they are used, and the tax differences and benefits between S corporation and C corporation ESOP-owned companies. Attendees will learn about who runs and controls an ESOP-owned business, how ESOP shares are valued compared to other sale options, and how employees can benefit personally and become more productive.

Menke to Sponsor 2022 Midwest Regional ESOP Conference

The ESOP Association 2022 Midwest Regional Conference is just around the corner, and Menke & Associates, Inc. is proud to be a bronze sponsor! This year’s conference will be held in Milwaukee, Wisconsin, from September 20-22nd. The conference will feature a variety of sessions on topics such as employee ownership, succession planning, and employee benefits.…

Menke Client, Mower Ad Agency Becomes 100% ESOP-owned

Syracuse, N.Y. — Eric Mower, who turned his Syracuse-based ad agency into one of the largest independent marketing communications firms in the country, has sold ownership of the company to his employees. The agency said Wednesday that Mower transferred 100% ownership of the company to a newly formed employee stock ownership plan. The agency’s executive…

Nautic Partners Announces Investment in IT Solutions

FORT WASHINGTON, PA. & PROVIDENCE, R.I.–(BUSINESS WIRE)–Nautic Partners (“Nautic”) is pleased to announce that it has finalized the recapitalization of IT Solutions Consulting, Inc. (“ITS”), a market-leading managed information technology (IT) service provider servicing commercial clients throughout the northeast, in partnership with ITS management. Headquartered in Fort Washington, PA, ITS is a full-service IT services…

ESOPs Fight the Great Resignation with Retirement Savings

Employees are leaving their jobs at record rates. The Bureau of Labor Statistics reported that nearly 9 million Americans quit their jobs during the last two months of 2021 alone. Who among us has not had the experience recently of seeing a favorite local business with a sign in the window saying, “Sorry, we are…

Colorado Real Estate Brokerage Shows the Versatility of ESOPs

Employee Stock Ownership Plans are sometimes viewed as only being a good fit for certain specific industries. Manufacturing businesses, for instance, make up roughly a quarter of all ESOP companies. Architecture, engineering, and construction firms have embraced ESOPs at an increasingly rapid rate and have seen a marked benefit, reporting a 35% higher median value…

Colorado Launches Tax Credit to Help Businesses Become Employee-Owned

If your business is based in Colorado and you are considering employee ownership as part of your succession plan, or simply as a way to reward the workers who have helped you get to where you are, the decision just became $100,000 easier. Governor Jared Polis announced that the CO Office of Economic Development and…

Menke Assists George & Lynch Transition to Employee Ownership

Menke & Associates was proud to assist George & Lynch, Delaware’s largest commercial construction company, with the installation of an Employee Stock Ownership Plan (ESOP) at the end of 2021. Headquartered in Dover, George & Lynch has been building critical infrastructure in and around Delaware since 1923, tackling projects ranging from roads and bridges to…

Wawa’s ESOP Helps Them Become the Largest Company in PA

Convenience chain Wawa is one of the largest ESOPs in America. Now, a power ranking by Forbes has named them as one of the largest private companies in America, as well. Wawa ranked 29th, with a revenue of $11 billion and 38,000 employees, making them the largest privately owned company in Pennsylvania. Wawa ranked well…

Andesa Services Embodies the Spirit of Employee Ownership Month

In 2015, Menke & Associates, the nation’s premier full service ESOP firm, served as advisor in the design and implementation of an ESOP for Andesa Services, the leading provider of integrated, cloud-based solutions for life insurance and annuity carriers and providers. In 2020, Andesa completed the transition to 100% employee-ownership. And in 2021, Andesa demonstrated…

Menke Client Russell Bond & Co. Acquired By Jencap

In October, 2021, Russell Bond & Co., Inc., a Buffalo, NY-based insurance wholesaler and longtime Menke client, announced that they had agreed to become part of Jencap Group, one of the largest insurance wholesalers in America. Gary Hollederer, President and COO of Russell Bond & Co., described the decision to join Jencap as being driven…

Phil DeDominicis Discusses Employee Stock Ownership Plan Basics on How to Hardscape Podcast

November 11th, 2021 — Menke Group Managing Director, Philip DeDominicis was recently featured on the How to Hardscape podcast in an episode, entitled, “Employee Stock Ownership Plans with Menke & Associates.” In the episode they outline how to give workers an ownership interest in a company — ESOP benefits, the kinds of companies employee ownership…

Phil DeDominicis to Present Free CPE Webinar on ESOPs – Nov. 11th

Nov 11, 02:00 PM EST — Phil DeDominicis will be presenting a free webinar, giving an overview on ESOPs for owners, CFOs & CPAs. Click Here to Sign Up The CPE/CE webinar qualifies for 2 credits and provides a broad overview of ESOPs with the following topics: Key topics discussed in this online CPE/CE course: Using…

Millennial Workers Are Drawn to Employee Ownership Values

ESOP companies are attractive to millennial workers because they offer benefits and a culture that fit what they are looking for. They provide powerful retirement savings at a time when perks that their parents may have enjoyed, like robust pension plans, are nearly impossible to find.

Matthew Nels to Speak at Great Game of Business Conference on Sept. 9

On September 9, 2021, Menke Group Managing Director of ESOP Advisory and Investment Banking Matthew Nels will be speaking at the Great Game of Business Conference in Dallas. His presentation entitled, How Business Owners, Management, and Employees Can Benefit from ESOPs, will explore the range of ownership transition options that business owners might consider, and…

Menke Client Global Tax Management Named to Inc. 5000

The Menke Group is proud to congratulate longtime client Global Tax Management on their recent placement on the 2021 Inc. 5000 list. The Inc. 5000 is the definitive ranking of the fastest-growing private companies in America. GTM earned their position by posting 58% revenue growth over the last three years. Headquartered in Wayne, PA, Global…

When ESOP Companies Make Strategic Acquisitions, Everybody Wins

One benefit of Employee Stock Ownership Plans (ESOPs) that should not go overlooked is how they can help companies grow. Not only are ESOPs powerful tools for recruiting and retaining top talent, but they also empower companies to make strategic acquisitions that help them become market leaders in their fields. ESOPs help companies make strategic…

Homegrown Organic Farms Protects Their Culture and Rewards Their Workers with an ESOP

On May 1st, 2021, Porterville, CA fruit growers Homegrown Organic Farms completed their transition to employee ownership with the implementation of an Employee Stock Ownership Plan (ESOP).

Client Case Study: WestLand Resources ESOP Embodies History and Innovation

Many businesses like to say that their most valuable resource is their people. WestLand Resources, Inc.’s (WestLand) Engineering & Environmental Services puts that belief into action. The Menke Group is proud to have assisted WestLand with their successful transition to 100% employee ownership through the creation of an Employee Stock Ownership Plan (ESOP) at the…

Forbes Examines the Power of ESOPs to Combat Wealth Inequality

In a recent article in Forbes entitled, “The ESOP Revolution: Fighting Financial Inequality And Empowering The Working Class,” author Christopher Marquis examines the “transformative power of employee ownership” in combatting the massive wealth inequality in America. Marquis argues that businesses can claim to be “sustainable and socially responsible,” and may back up those claims with…

Harvard Business Review Touts “Big Benefits of Employee Ownership”

In a recent article published in the Harvard Business Review entitled “The Big Benefits of Employee Ownership,” Thomas Dudley, CEO and co-founder of Certified Employee-Owned, and Professor Ethan Rouen of Harvard Business School shared the results of a study based on a single question: what would happen if every American business became at least 30%…

MyPath Wins ESOP Company of the Year Award for Their Focus on Employee Communications

MyPath, an employee-owned family of companies that provides comprehensive services to children and adults with physical and mental disabilities, has been named the ESOP Company of the Year by the Wisconsin chapter of The ESOP Association. Based in Oconomowoc, WI MyPath has over 2,000 employee-owners serving Wisconsin and Indiana. They have been 100% employee-owned since…

Phillip DeDominicis to Speak at 35th Annual Ohio Employee Ownership Conference

On May 7th, Menke Managing Director Phillip DeDominicis will be speaking at the Ohio Employee Ownership Conference to be held at Kent State University. Phil will be giving a presentation entitled, “Employee Owner Track: ABCs of ESOPs for ESOP Participants,” which will cover how to provide new employees with the essentials of what it means…

AEC Firms with ESOPs Valued 35% Higher, According to New Study

Architecture, engineering, and construction (AEC) firms with Employee Stock Ownership Plans outperformed traditionally-owned AEC firms in four out of six valuation categories, according to Zweig Group’s recently released 2021 Valuation Report of AEC Firms. These findings demonstrate how an ESOP can create wealth for employees and owners alike in these vital industries. Notably, the report…

Why the Right Time to Create a Succession Plan is Today

If there is one lesson to be learned from the upheaval of the past year, it is the importance of having a succession plan in place. No one can anticipate all the challenges that could accompany a global pandemic or a sudden massive economic crash, but having a roadmap for keeping your business intact in…

Harley-Davidson Revs Up Employee Ownership

Motorcycle manufacturer Harley-Davidson has announced that it will be issuing stock to 4,500 of its employees, including every one of its hourly factory workers. With this move, Harley-Davidson will become one of the most recognizable employee-owned companies in America. Harley-Davidson has suffered from falling sales in recent years. Giving so many workers an ownership stake…

The Menke Group Welcomes Michael Dee and Jessica Quaday to our Annual Administration Staff

The Menke Group is proud to welcome Senior Benefits Consultants Michael Dee, MBA, QKA and Jessica Quaday, QKA to our Annual Administration team. Accurate, reliable, and efficient recordkeeping is the backbone of a healthy ESOP, and our team of highly trained and experienced administrators are here to handle any ESOP recordkeeping challenge. Mr. Dee and…

Biden Administration Nominates ESOP Advocates to Head SBA and Labor Department

President-Elect Joe Biden has signaled his intentions to promote employee ownership during his administration through the nominations of two vocal proponents of Employee Stock Ownership Plans to critical positions: Marty Walsh for U.S. Secretary of Labor and Isabel Guzman to head the Small Business Administration. The Menke Group joins the ESOP Association in expressing our…

Menke Client Ganahl Lumber Named LBM Dealer of the Year

The Menke Group is thrilled to congratulate longtime client Ganahl Lumber on being named 2021’s Dealer of the Year in the $100 million+ category by LBM Journal, the leading media company serving the lumber/building material distribution industry. Ganahl Lumber has been providing quality lumber products to the greater Los Angeles metro area since 1884. Their…

Upcoming CPE Webinar: ESOP OVERVIEW FOR OWNERS, CFOS & CPAS

Please join me for a highly interactive, LIVE webinar on Thursday, January 07, 2021 | 02:00 PM EST to learn more about “ESOP OVERVIEW FOR OWNERS, CFOS & CPAS”. Attending this webinar will also qualify you for FREE CPE/CE Credits. Here are a few key learning objectives for the workshop: To identify when ESOPs may…

Menke Client Graham Company Reflects on Three Years of 100% Employee Ownership

In 2017, the Menke Group had the distinct pleasure of helping Philadelphia-based insurance brokers and consultants Graham Company buck industry trends by converting to 100% employee ownership. Now, in a terrific new article published on Property Casualty 360, Graham’s VP of Human Resources Karen Boyle looks back on their first three years as an ESOP…

Upcoming Webinar: How an ESOP Can Provide Corporate and Shareholder Liquidity During the COVID-19 era

Thursday, January 14, 2020 (1:00PM – 3:00PM EST) This 2-hour web seminar is free-of-charge and will show how ESOPs can be structured to accomplish these and other objectives that may be essential to the sustainability of your company in navigating through this difficult period. The COVID-19 pandemic will likely have a financial impact on most…

ESOP Companies Outperform Other Firms During COVID-19 Pandemic

Companies with Employee Stock Ownership Plans have “drastically outperformed” traditionally owned businesses at retaining jobs during the COVID-19 pandemic by a rate of 4 to 1, according to a new report released by the Rutgers Institute for the Study of Employee Ownership and Profit Sharing in partnership with the Employee Ownership Foundation. This report, which…

Fireclay Tile Becomes the Bay Area’s Next Employee-Owned Ceramics Company

San Francisco’s Fireclay Tile has followed its peer, Menke client Heath Ceramics, into employee ownership. Fireclay had previously given its employees a 14% stake in the company in 2013, and has now expanded the employee’s ownership stake by an additional 23%, meaning the workers own more than a third of the business. Home to 150…

Davey Tree Shows Strength of ESOPs for the Landscaping Industry

The Davey Tree Expert Company, headquartered in Kent, OH, was recently named the 9th largest ESOP company in America according to a report by the National Center for Employee Ownership (NCEO). With approximately 10,500 employee-owners, Davey Tree is among the largest landscaping companies in the US, regardless of ownership structure, and is a good example…

Survey Shows Consumers Prefer Companies with ESOP Values

We here at The Menke Group have previously argued that the COVID-19 pandemic is an opportunity for change, for creating a more equitable economy, a better capitalism. We have said that the future of the American economy will hinge on employee ownership, and on ESOPs in particular. We have written about the ways ESOP companies…

Menke Congratulates Applewood Seed Company on Transition to Employee Ownership

The Menke Group was proud to advise and assist Colorado-based Applewood Seed Company, a wholesale supplier of bulk wildflower and garden seeds, with the design and implementation of their Employee Stock Ownership Plan (ESOP). The transaction, which closed on July 31st, 2020, is a critical component of the company’s comprehensive succession plan, and will keep…

ESOPs: The Future of a Better American Economy

As the COVID-19 pandemic rages on, many of us are wondering when things will get back to normal. When will life be normal again? When will business be normal again? What many people—business owners, workers, even politicians—are starting to realize is, the old normal may never come back. And that could actually be a good…

Phillip DeDominicis Discusses ESOPs in the Current Economy with Ohio Employee Ownership Center

Menke Managing Director Phillip DeDominicis recently participated in a conversation with Chris Cooper, Program Coordinator of the Ohio Employee Ownership Center (OEOC) at Kent State University, to discuss the state of the ESOP industry in the COVID economy. In this discussion, Phil draws on his 30 years of investment banking experience to assess the realities…

How an ESOP Can Power Your Company’s Post-Shutdown Recovery, Part 2: Succession ESOPs

This article is part of a series. For Part 1: Employee Incentive ESOPs, click here The COVID-19 pandemic has forced many owners to start thinking seriously about what their business would look like without them around to run it. Would it keep going? Would it be ready for another shutdown? The pandemic has presented the…

John Menke Receives Founding Supporter Award from Rutgers School of Management and Labor Relations

On June 23, 2020, as part of the annual Beyster Symposium held by the Rutgers Institute for the Study of Employee Ownership and Profit Sharing. Menke Group founder John Menke was honored with the Founding Supporter award in recognition of his decade of support for the Institute, its conferences, and the creation of an employee…

How an ESOP Can Power Your Company’s Post-Shutdown Recovery, Part 1: Employee Incentive ESOPs

On a recent episode of LinkedIn’s This Is Working podcast, Mark Cuban had a straightforward suggestion for how to keep employees engaged, motivated, and committed as the economy starts to come back to life: “Give them stock in a meaningful way,” he said. “You’re going to need them to grow your company. We all are…

How ESOPs Can Help to Close the Racial Wealth Gap and Promote Economic Justice

Written in collaboration with Hilary Abell, co-founder, Project Equity Black Lives Matter protests are currently continuing into their fourth week in cities and towns across America, shining a spotlight on the injustices of systemic racism. These protests have already had a positive impact, and if they can bring about a true reckoning with the violent…

How Longtime Menke client Hansen Plastics Transitioned to Employee Ownership

At our October 2019 board meeting the younger board members expressed a desire to hear the story of why and how I chose to transition company ownership from me, a sole stockholder, to an “ESOP.” Here is my brief explanation. We started HPC in 1971 on a shoestring, with a used 40 ton molding press,…

How a Repurchase Obligation Study Can Help Your ESOP Survive the Pandemic

The COVID-19 pandemic has dramatically shifted the economic landscape virtually overnight. The financial picture your business may have been looking at as of December 31, 2019 could be very different today. Many ESOP-owned companies are understandably focused on what this means for their annual valuation. But the next big threat to your business’s capital may…

How an ESOP can help your company survive a pandemic

April 20th, 2020 On a recent episode of the Daily Social Distancing Show with Trevor Noah, special guest Mark Cuban discussed how to revive the economy in the wake of a global pandemic. Cuban relayed some of the advice he’s shared with President Trump as part of his involvement on the coronavirus task force. “The…

Lessons in Resilience: How ESOP Companies Maintained Employee Morale During the Great Recession

With the COVID-19 pandemic casting a cloud of uncertainty and instability over the economy, leading to record numbers of unemployment claims, you may have heard people (including us) saying that ESOP companies are more resilient in the face of adversity. It’s true. Studies have repeatedly shown that ESOP companies: Had 50% fewer layoffs than traditionally…

CARES Act resources for your ESOP

We hope everyone at your company is ok during this uncertain time. This article highlights two immediate resources your company may qualify for under the CARES Act: the Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP). #1 Economic Injury Disaster Loan (EIDL) The online application for EIDLs is open right now and…

COVID-19 and Your ESOP: What You Need to Know

As COVID-19 spreads across the country, we know that your health and the health of your fellow employee-owners is your top priority. And we know you are also concerned about the health of your ESOP. Will it be there as a resource for those who need it most in the times ahead? The Menke Group…

Skyline Construction Brings Employee Ownership to Two More Companies with Acquisition of Unimark and Servicemark

March 16th, 2020 Skyline Construction Enterprises, a San Francisco-based, 100% employee-owned commercial general contractor specializing in commercial interiors, has acquired Seattle’s Unimark Construction Group and its tenant services sister company Servicemark. These acquisitions give the Skyline Group a major foothold in the Pacific Northwest—a key component of their nationwide expansion plan, according to the company’s…

Client Case Study: Basden Steel Achieves 100% Employee Ownership

The Texas-based Basden Steel group of companies have been providing fabrication and erection operations for the commercial construction industry since 1985. They have built everything from schools to casinos to arenas to military facilities. On January 1, 2020 Basden Steel built a new legacy by turning its 450 employees into owners through the sale of…

Menke Client SRC Wins International Award for Promoting Employee Ownership Mentality

March 9th, 2020 SRC Holdings Corp., which is the oldest employee-owned remanufacturer to original equipment manufacturers in North America, was recently awarded the 29th annual Txemi Cantera International Prize in Bilbao, Spain. This award is given to organizations in recognition of their support for their workers and reinforces the values of cooperation, solidarity, participation, and…

Why Is It Necessary to Restructure America?

Socialism and communism developed as a reaction to the concentration of ownership and the abusive labor practices that developed in the early stages of capitalism. However, after nearly a century of conflict between these two competing economic systems, a century that witnessed two world wars and a protracted cold war, we have seen in the…

Bob’s Red Mill ESOP Turns 10

March 4th, 2020 In 2010, Bob Moore, founder of the whole grain flours and cereals company Bob’s Red Mill, celebrated his 81st birthday by giving his employees the gift of ownership. Ten years later, the Bob’s Red Mill ESOP is going strong with roughly 600 employee-owners—three times the number they had when the ESOP began—and…

Congress Looks to ESOPs to Brace for the Silver Tsunami

February 12, 2020, ESOP Association member Daniel Goldstein, President and CEO of Folience, testified before the U.S. House Small Business Committee about the need for the Department of Labor to clarify its ESOP regulations given the impending retirements of 2.5 million baby boomer business owners. This mass retirement, known as the silver tsunami, represents the…

GreenScapes Is the Latest Landscape Design Company to Become Employee-Owned

February 6th, 2020 In January, Columbus, OH-based GreenScapes Landscape Company became the latest landscaping firm to make the transition to employee ownership. Founded in 1977 by Bill Gerhardt, who intends to stay on as president for at least five more years, Greenscapes began as a traditional landscaping business and has expanded into a full-service landscape…

Business bests: Employee stock ownership plans explained

Written by Jill Odom, this article was originally published at TotalLandscapeCare.com February 4th, 2020 There are a lot of myths and mysteries that surround employee stock ownership plans (ESOPs) and some of these misconceptions can scare landscape company owners away from considering this business option. Make no mistake, some ESOP structures are complex, but they…

Houchens CEO Retires as Head of One of America’s Largest ESOP Companies

Earlier this month Jimmie Gipson, 78, announced he would be retiring as of March 31st, 2020 from Houchens Industries, where he has worked for 55 years, the last 27 as CEO. Houchens, which began over 100 years ago with a single grocery store in Barren County, KY, has grown to encompass multiple retail grocery chains,…

An ESOP Helps Loftness Specialized Equipment Stay True to Its Roots

On January 1st, 2020, Loftness Specialized Equipment, an agricultural equipment manufacturer based in Hector, MN, became 100% employee-owned, and in doing so, reconfirmed its longstanding commitment to the town of Hector and the community who helped make the company what it is today. Dick Loftness started the company that would eventually become Loftness Specialized Equipment…

Insurance Tech Company Andesa Services Becomes 100% Employee-Owned

Pennsylvania’s Andesa Services, which provides integrated, cloud-based solutions for life insurance and annuity carriers and providers, started 2020 by selling 100% control of the company to its 165 employees through an ESOP. “This is one of the most exciting days of my life and I hope you share my excitement,” Andesa founder John Walker said…

Cross Company Grows and Creates a New Wave of Employee-Owners with Acquisition of Flow-Tech

January 3rd, 2020 Cross Company, a 100% employee-owned industrial solutions company based out of Greensboro, NC, announced its acquisition of Flow-Tech, a Maryland-based process instrumentation and measurement technology sales and service provider earlier this week. All of Flow-Tech’s employees will be eligible to join Cross’s team of nearly 700 associates in participating in the company’s…

Pennsylvania House Advances Bill to Extend ESOP Tax Benefits for Sellers

January 17th, 2020 At the end of 2019, the Pennsylvania House of Representatives voted 130-67 to advance HB 285, a bill that would further incentivize business owners in PA to sell to ESOPs by enabling sellers to avoid hefty taxes on their proceeds at both the state and federal level. “ESOPs serve the dual purpose…

Barrio Brewery Is the Latest Craft Brewery to Become Employee-Owned

January 13th, 2020 Barrio Brewery, Arizona’s oldest craft brewery, started off 2020 by selling 100% control of the company to its employees through an ESOP. Any of the brewery’s 70 employees who work 1,000 hours or more in a one year period will be automatically enrolled in the plan. For Dennis and Tauna Arnold, who…

Founder and President John Menke to present at the 2020 Kelso Fellowship Workshop

Founder and President John Menke to present at the 2020 Kelso Fellowship Workshop January 10-12th at Rutgers University New Brunswick, NJ. He will speak on the Universal Capital Accounts and Citizen Dividend Program. The purpose of the annual workshop is to study broad-based forms of capital ownership and capital income such as employee stock ownership,…

Client Case Study: International Wine Management Company Intervine Celebrates Their First Year with an ESOP

In December 2018, Menke & Associates helped Intervine, a Napa, CA-based wine management company serving the travel industry, with the successful transition to 100% employee ownership. A year later, on the first anniversary of their ESOP, co-founders Colleen May and Michael Borck, who continue to serve as Chairman and Vice Chairman of the Board respectively,…

Ringland-Johnson Construction Secures Its Family Legacy with Menke ESOP

In 1946, Carroll Johnson founded Ringland-Johnson Construction. In 1971, Carroll Johnson handed control of the company to his son, Larry. In 1996, Larry Johnson handed control to his son, Brent. And in 2019, Brent Johnson began the process of handing control of Ringland-Johnson Construction to its employees. Menke & Associates assisted Ringland-Johnson, the largest commercial/industrial…

Dixie Plywood and Lumber Company is now 100% Employee-Owned

November 17th, 2019 Dixie Plywood and Lumber Company (DIXIEPLY), a leading wholesale distributor of building materials, is proud to announce it has become 100% employee-owned through an Employee Stock Ownership Plan(ESOP). The ESOP was announced to DIXIEPLY’s employees on November 1st by Dan Bradley, President of the 75 year old company. The ESOP became effective…

Menke Celebrates 45 years of Employee Ownership, to Present at the 2019 Employee Owned Conference in Las Vegas

November 11th, 2019 Menke was formed upon passing of ERISA on Labor Day 1974 to enable business owners to sell their companies to their employees through an Employee Stock Ownership Plan, or ESOP. 45 years later, our mission remains the same: to make employee ownership available to the largest number of employees. We relate with our…

Client Case Study: Menke ESOP Helps Landscape Architecture Firm MKSK Live Its Values

How can an ESOP help your regional business compete with larger, national firms? The answer: By putting your company’s money where its mouth is. In Q3 2019, Menke & Associates, Inc. assisted innovative landscape architecture and urban design firm MKSK in successfully converting to 100% employee ownership. MKSK was born out of the 2011 merger…

MKSK Inc. – a Colombus-based architecture firm – now employee-owned

MKSK Inc. has become an employee-owned company through the creation of a new employee stock ownership plan, or ESOP. MKSK, a landscape architecture, urban design and planning firm, announced through a news release that it has created an employee stock ownership plan to provide long-term ownership and organizational stability. The move also seeks to “secure…

Menke to be featured at Annual Conference of Hawaii Chapter of ESOP Association on October 17th

October 15th, 2019 Victor Alam, Corporate Counsel for Menke, to lead Sessions 1 and 3 on October 17th: – Session 1: Current Issues Facing ESOP Companies: Legal, Financial, Operational & Transactional – Session 3: Special ESOP Administration Issues: Mature ESOPs, Repurchase Liability, Plan Features As an attorney, Victor specializes in the design and installation of ESOPs, as…

Menke to present at the 2019 Western States ESOP Association Conference, October 3-4

Oct. 2nd, 2019 ESOP Distributions: Concepts, Requirements, and Best Practices Michael Pasahow, Senior Counsel for Menke, will present best practices for employee stock ownership plan distributions on October 4th. He will cover the key issues governing ESOP distributions – eligibility, timing, method, form and manner – a critical element of cashflow and share repurchase needs…

Planning For ESOP Repurchase Obligations Webinar

Powered by Employees! Learn How To Use Your Employee Ownership To Gain Competitive Advantage Menke has teamed up with Certified EO to help our clients increase employee engagement, attract customers and top talent, and spread the word of employee ownership. During this 30-minute webinar, we’ll cover the benefits of being a Certified Employee-Owned company. Co-presented…

Menke to present at the 2019 NCEO Fall ESOP Forum September 17-18

Sept. 16th, 2019 Assessing ESOP Feasibility: What are the financial, strategic, and cultural issues involved in determining if an ESOP makes sense? Chuck Bachman, Senior Counsel for Menke, will lead the ESOP feasibility session on September 17th. He will cover the key issues – financial, strategic, and cultural – that ultimately determine if an ESOP is…

New Belgian Brewing Video Highlights ESOP Success

“How New Belgium Brewing Sold the Company – and Became More Successful in the Process” As party of the Return on Values Project, New Belgian Brewing – makers of Fat Tire Beer – produced a video outlining how becoming employee-owned has positively affected both their employees and their profits. New Belgian Brewing started with a…

NewAge Industries Now 100% ESOP-owned

September 9th, 2019 NewAge Industries established its ESOP in January 2006, when CEO Ken Baker sold 30% of the company to the employees as a way to ensure the company’s continuation. The ESOP added a new facet to the company’s culture, namely the pride of ownership, while it discouraged a buyout from a competitor or…

Upcoming Seminar: Practicing the Great Game and Transitioning Ownership

Friday, September 6 Now that The Game has transformed your organization and everyone is working toward common goals, how do you as the owner or management team ensure a successful ownership transition without disrupting your success? We will discuss the pros and cons of the ownership transition options available to a business owner/management team and…

Davey Tree Celebrates 40 Years of Employee Ownership

July 11th, 2019 Davey Tree, one of the largest tree service companies in the U.S., became employee-owned 40 years ago. Since then, its employee count has grown from 2,800 to nearly 10,000, and its stock from 12 cents to $21, a compound annual growth rate close to 14%. Davey Tree has been employee-owned since 1979…

Employees See Real Gains of Stewart’s Shops’ Growth Through ESOP

July 8th, 2019 Stewart’s Shops Partners of Saratoga Springs, NY, have received their profit sharing statements. Existing ESOP accounts received approximately 13% growth on their existing accounts including over 6% in dividends. This success is from the service resulting in increased operating profitability and the changes in the Federal corporate tax law. The company has made a…

Employee-Owned Consigli Construction is ENR New England’s Contractor of the Year

July 1st, 2019 Consigli Construction Co., selected as ENR New England’s Contractor of the Year. Transforming into a 100% employee-owned enterprise, the 114-year-old Milford, Mass.-based contractor and construction management firm reported $1.09 billion in regional revenue, placing it third among ENR New England’s Top Contractors list. The firm ranks in the Top 60 in ENR’s national…

Sanderson Farms named one of “America’s Best Employers” by Forbes

June 27th, 2019 The company was bestowed the honor of “best employer” by its own employees. With over 1,200 employees Sanderson Farms processes over a million chickens a week. The Forbes list is assembled through an anonymous online survey of 50,000 Americans working at companies with more than 1,000 employees. Sanderson Farms has invested more than $130 million…

Cianbro Creates 500 New Employee Owners through 100% ESOP

June 21st, 2019 Pittsfield, MA based Cianbro, a construction firm with 4,000 employees and operations in 41 states, is expanding its footprint with the acquisition the engineering and construction firm A/Z Corporation of North Stonington, Connecticut. A/Z’s 500 employees will become equity participants in the expanded company through Cianbro’s employee stock ownership plan. Cianbro is…

ESOPs Increase Probability of a Happy Workforce

June 20th, 2019 ESOPs increase the probability of creating a happy workforce for Financial Advisory firms. A report by InvestmentNews sheds light on the practices that play the biggest role in setting the Best Places apart from the competition by taking a deeper look at the data firms provide in order to be considered for the list. Read…

Menke client and 100% ESOP owned Delta Consulting Group is listed in the 2019 Global Arbitration Review (GAR) 100

June 17th, 2019 Menke client and 100% ESOP owned Delta Consulting Group is listed in the 2019 Global Arbitration Review (GAR) 100, which is a publication that identifies the top law firms and expert witness firms in the international arbitration discipline. Read More at: https://delta-cgi.com/professionals/who-s-who-legal-gar-100 Employee Stock Ownership Plans or “ESOPs” are a viable tool…

Wilson Electric Announces 100% Employee Ownership Deal

May 21st, 2019 Wilson Electric Services Corp. of Tempe, AZ announced that the company’s ESOP (Employee Stock Ownership Plan) has purchased the balance of the company shares, making it 100 percent employee-owned. Wilson Electric, a leader in the electrical contracting industry, has been a partial ESOP since 2005 when the plan previously held a 47%…

Rutgers ESOP Study: Employee Ownership Narrows Gender and Racial Wealth Gaps

May 17th, 2019 Did you know? #1 – Four in 10 adults, if faced with an unexpected expense of $400, would either not be able to cover it or would cover it by selling something or borrowing money? #2 – 28% of senior citizens in the United States retiring between 51 and 61 had zero…

The Hilb Group acquires ESOP-owned Walker Brothers Insurance Inc.

May 2nd, 2019 Springdale-based Walker Brothers Insurance Inc. has been acquired by The Hilb Group LLC (THG). Walker Brothers was previously owned by Mike Luttrell (President) and other employees of the company through an employee stock ownership plan (ESOP). THG is a middle market insurance agency headquartered in Richmond, Va., and is a portfolio company of Boston-based private equity firm,…

Van Horn Automotive Group recognized as the Wisconsin ESOP Company of the Year

April 25th, 2019 Wisconsin has approximately 185 ESOP owned businesses. Van Horn Automotive Group was recently recognized as the Wisconsin ESOP Company of the Year. The Van Horn has been a family owned business for over 50 years. Joe Van Horn moved from Chicago, IL to Plymouth, WI to open his first store; and since…

Upcoming Webinar: How To Sell Your Business To An ESOP – For CFOs and Business Owners

Monday, April 22, 2019: 8:00 AM PDT Course Description — This webinar will describe the tax and financial benefits benefits, structure, and process of selling a privately held business to an Employee Stock Ownership Plan (ESOP). Designed for CFOs and business owners, this informative course first describes the ABCs of ESOPs but will then cover: Special…

Richard L. Bowen + Associates Announces 100% ESOP

April 11th, 2019 Founded in 1959, Cleveland, Ohio based architecture and engineering firm Richard L. Bowen + Associates announced it will become 100% employee owned on April 1st through its Employee Stock ownership Plan (or “ESOP”) . Bowen’s ESOP was established in 2007, but in 2019 the ESOP will purchase the remaining 60% of the…

ESOP-Owned KI Industries, Inc. Ranked #2 on 2019 Best Places to Work

April 7th, 2019 Berkeley, Ill.-based KI Industries Inc., a supplier of decorative plastic and die-cast components, ranked No. 2 on the 2019 Best Places to Work list. It also happens to have an Employee Stock Ownership Plan (or ‘ESOP”). Getting employees more engaged after adopting an ESOP means different things for different companies. For KI,…

Visit us at the 2019 Employee Ownership Conference from April 8th-11th

Attending the 2019 Employee Ownership Conference? If so, there are 3 easy ways to connect: #1: On Tuesday April 9th, hear Chuck Bachman speak about The 2018 Main Street Employee Ownership Act and its Impact on SBA Lending. Chuck is our Senior Corporate Counsel. As a CPA and attorney, he specializes in the design and…

Client Case Study: Menke ESOP is the First-Class Succession Solution for a Luxury Goods Supplier

In 2018, Menke & Associates, Inc. assisted a unique, deeply relationship-driven service business with its successful transition to 100% employee ownership. The company’s two shareholders had built a $40 million-dollar entity with a worldwide, disparate supplier network, multiple Fortune 100 clients, and global operations in a heavily-regulated industry and were ready to continue their ownership…

ESOP-Owned EVAPCO Celebrates 40 Years in Business

April 2nd, 2019 Evapco, an employee owned company (ESOP) and an international manufacturer of cooling and refrigeration products, celebrated 40 years in southwest Madera, California. Evapco Madera was the second manufacturing plant that Evapco created having being founded in Baltimore in 1976. Read More at: http://www.maderatribune.com/single-post/2019/03/27/Evapco-West-marks-40-years-in-business Employee Stock Ownership Plans or “ESOPs” are a viable tool…

How Crafts Technology Fosters Innovation Among Its Employee Owners

March 29th, 2019 For Crafts Technology of Elk Grove Village, Illinois, building an innovative culture required asking for intellect, sharing ownership, and rewarding good ideas. The company, one of the oldest continually operating tool companies in the U.S., has expertise in cutting, tooling, and shaping ultra-hard materials. Their precision tools are used in the manufacture of…

Chelsea Green Publishing goes 100% ESOP

March 28th, 2019 Vermont-based Chelsea Green Publishing is now fully employee-owned, marking the completion of an eight-year transition initiated by founders Margo and Ian Baldwin. Through an employee stock-ownership plan (ESOP), the company purchased ownership shares from the Baldwins on behalf of the 25 employees of the owners of the independent publishing house. Read More:…

Colorado: The New Delaware of ESOPs?

March 27th, 2019 Democratic Colorado Governor Jared Polis’ administration is putting together an Employee Ownership Center within the Colorado Office of Economic Development and International Trade The center will work with law firms and accountants to simplify the process and reduce costs associated with converting to an ESOP or Employee Stock Ownership model. Read more at: https://nonprofitquarterly.org/2019/03/26/colorado-says-it-wants-to-be-the-delaware-of-employee-ownership/ Menke & Associates,…

Does your ESOP Plan document correctly provide for the ESOP distribution procedures actually used at your company?

By Victor Alam, Esq We recently came across a company whose ESOP distribution procedures prohibited participants from electing a stock distribution. Those plan provisions were in the original plan document when the ESOP plan was first adopted years ago. When the company converted from an S corporation to a C corporation a few years later,…

High Performance Ownership: employee owned Architecture, Engineering & Construction firms command higher valuations

By Trevor Gilmore Zweig Group’s recently released 2019 Valuation Survey of AEC Firms highlights an important trend in employee ownership performance. Zweig focused on nationwide AEC firms – i.e. architecture, engineering & construction firms, of all sizes. From a valuation perspective, firms with employee stock ownership plans (ESOPs) performed better than non-ESOP firms in five…

Could ESOPs spell the future of business ownership?

Growing numbers of U.S. companies are giving workers financial stakes via employee stock ownership plans Aritcle by Judy Stringer. Reposted from the original article at Crain’s Cleveland Business There are a few lingering questions when it comes to Great Lakes Brewing Co.’s newly announced employee stock ownership plan, or ESOP. How many shares employees will receive,…

Menke Client, Heath Ceramics, Made Its Employees Into Owners. Should You?

Reposted from the original article at Business of Home HEATH CERAMICS, MADE ITS EMPLOYEES INTO OWNERS. SHOULD YOU? JAN 9, 2019 FRED NICOLAUS In 2015, Robin Petravic and Catherine Bailey, co-owners of iconic California ceramics brand Heath, were looking ahead to the 15th anniversary of their tenure. Over the last decade, the couple had transformed the company from a struggling…

New Tax Act Benefits ESOP Companies And Makes Tax-Free Rollover Transactions More Attractive To Sellers

By John D. Menke, Esq. Now that the dust has settled following the passage last December of the Tax Cuts and Jobs Act of 2017 (“TCJA”), it is clear that the new tax act confers substantial tax benefits on businesses and their owners and also makes ESOPs even more attractive, both for existing ESOP companies…

ESOP Best Practices Web Seminar

Session 1 – Introduction Session 2 – ESOP and Retirement Plan Basics Session 3 – Basic ESOP Transactions Session 4 – S Corporation ESOPs Session 5 – Plan Operation Features: The Four Hurdles Session 6 – Advanced ESOP Transactions Session 7 – ESOP Valuation Session 8 – Corporate Governance Session 9 – Key Employee Incentive Plans Session 10 – Administration and Recordkeeping –…

Certified EO welcomes Menke & Associates as a Certified Employee-Owned founding member

SAN FRANCISCO – June 1, 2017 – PRLog — Menke & Associates, Inc., the nation’s largest and oldest employee stock ownership plan (ESOP) advisory firm, announced today that they are becoming a Founding Member of Certified Employee-Owned® (Certified EO), a new certification program for employee-owned companies. “Menke & Associates is majority owned by its employees.…

The Brix Group, a leader in commercial vehicle onboard communication systems, becomes 100% employee owned

The Brix Group, a leader in onboard entertainment and communication systems for the commercial vehicle industry, has become 100% employee owned. With the help of The Menke Group, The Brix Group has extended ownership to their employees by way of an Employee Stock Ownership Plan. In addition to helping create financial security for employees, the…

Purchase Warrants: A New Tool for Business Succession and Key Employee Retention

By John D. Menke, Esq. A & E firms, like other service businesses, face two challenges to business succession. First, how will the firm finance the buyout of the founders when they are ready to exit the business? Second, how will the firm best be able to provide equity incentives to attract and retain key…

The ABCs of ESOPs Webinar

This is a one-and-a-half hour live Audio/Web Seminar that covers the basics of ESOPs from A to Z. This Audio/Web Seminar is designed for company owners and financial officers who want to determine whether an ESOP might be a good fit for their company. This program is designed to provide a broad overview of the…

SolarCraft becomes 100% employee owned

SolarCraft, a well established Novato solar panel design and installation firm, has become 100% employee owned. With the help of The Menke Group, the principal owners of SolarCraft have extended ownership to their employees by way of an Employee Stock Ownership Plan. In addition to helping create financial security for employees, the plan is designed…

2014 Tax Reform Proposals

A new comprehensive tax reform proposal was introduced by House Ways and Means Committee Chairman Dave Camp on February 26th, 2014. Camp’s proposal would cut the tax rate for C corporations to 25% over a period of five years. It would also cut individual tax rates to two brackets (10% and 25%), but it would…

2016 Cost-of-Living Adjustments

The following is a list of affected sections of the Code and the 2014 limitations of interest to the ESOP community Code Section Description 2016 Limitations 2015 Limitations 401(a)(17) Limit on the amount of annual compensation taken into account $265,000 $265,000 402(g)(1) Limitation on the exclusion for elective deferrals described in Section 402(g)(3) of the…

Tax Alert: Capital Gains Rates to Rise

This may be the opportune time to take action to avoid the increase in capital gains tax rates that will most likely take effect next year. According to the Kiplinger Tax Letter, Congress will likely increase the tax rate on long term capital gains for high income individuals from 15% to 20% starting next year.…

Seven Common ESOP Myths and Misconceptions

ESOPs were first authorized by federal legislation in 1974. Since that date, there have been more than 25 separate pieces of legislation that have further defined what an ESOP is and what an ESOP is permitted to do. Despite this fact, significant misconceptions about ESOPs persist. The following describes some of the more prevalent myths…

New Study Shows Jobs Grew 60% in S-ESOPs While Others Remained Flat

A study released today by Alex Brill, former advisor to the Simpson-Bowles bipartisan deficit reduction commission and a fellow at the American Enterprise Institute, finds that private employee stock ownership plans (ESOPs) organized as S corporations increased employment over the last decade more quickly than the overall private sector. Among surveyed “S-ESOP” companies, the Brill…

The Employee Stock Ownership Trust – A New Trend In Employee Benefits and Corporate Finance

An increasing number of companies are turning to Employee Stock Ownership Trust financing as a means to simultaneously raise low cost capital and provide increased employee incentives and retirement benefits while reducing the cost of qualified plan benefits. The Employee Stock Ownership Plan is a qualified plan under Section 401(a) of the Internal Revenue Code.…

The Use of ESOPs to Finance Mergers and Acquisitions

Advantages to C Corporations Many companies that have ESOPs fail to realize that their ESOP can be used to the finance acquisitions with pre-tax dollars. Normally, when debt is incurred to finance an acquisition, only the interest payments are deductible. Principal payments are not deductible. However, if the acquisition is financed through an ESOP, both…

Howard's Appliance Celebrates Being 100% Employee Owned

The Los Angeles Times featured an article about Howard’s Appliance & Flat Screen Superstores, which has been 100% employee-owned since 2000. The company, which started as a radio repair shop in San Gabriel, sold nearly half of the company over to the employees when the government approved employee stock ownership plans in 1976. Employees acquired 100%…

Mills James Produces Animated Film About ESOPs

Mills James, a comprehensive creative media production company based out of Columbus, Ohio has made an animated film explaining how their Employee Stock Ownership Plan (and how ESOPs in general) work. Mills James employs about 150 employees and specializes in the following areas: Teleproduction, Broadcast Production, Business Video, Meetings & Events, Web Interactive and Original…

ESOP Technical Issues Web Seminar – October, 2011

Below you will find the links to watch each of the Technical Issues Webinar Sessions On-Demand: Session 1: Introduction What is an ESOP? History of ESOPs CLICK HERE TO WATCH SESSION 1 Session 2: Retirement Plan Basics Qualified vs. Nonqualified plans Types of Plans CLICK HERE TO WATCH SESSION 2 Session 3: Basic ESOP Transactions…

Great Falls Business Owners Explain "ESOPs"

Local business owners say they’re spreading the wealth in Great Falls by offering long term employees stock ownership plans or ESOP’s. It’s a structure that is set up and its federally recognized, so the employees are then part of a trust that then owns either a 100% of the company or some portion of the…

Options and Alternatives for Structuring ESOP Transactions Webinar

Program Agenda Valuation Considerations Sell Now Or Sell Later? Tax Considerations Pay Uncle Sam Now Or Pay Uncle Sam Later? To Participate In Esop Or Not To Participate? Financing Considerations To Borrow Or Not To Borrow? To Lend Or Not To Lend? Fiduciary Considerations To Serve As An Internal Fiduciary? Appointing An Independent Fiduciary Control…

Read about the Cal-Tex Protective Coatings ESOP

Read the original posting at the Cal-Tex Website Cal-Tex is 97% employee-owned through an Employee Stock Ownership Plan (ESOP).As the 2011 Grand Prize Winner of theNational Center for Employee Ownership’s Innovations in Ownership Award and the 2011 ESOP Association’s Best Communications Award (Small Company), Cal-Tex is committed to providing a company structure that will benefit the employee and…

ACG Kentucky panel talks about benefits of ESOPs

Click here to read the original article at bizjournals.com For business owners who want to cash out but still oversee the direction of the company and take care of their workers, an employee stock ownership plan might be the best bet. That was the message from panelists Tuesday morning at the monthly meeting of ACG…

Consider an ESOP as a Better Alternative When It Comes Time to Exit Your Business

(Why Selling Your Stock to an ESOP is Better than Selling to a Third Party) If you are the owner of a successful decorative plumbing or hardware business, sooner or later you will face the prospect of having to exit the business, either because you wish to retire or because you wish to cash in…

National Van Lines Becomes ESOP-Owned

National Van Lines Inc. said it has changed the company’s structure, selling itself to an employee stock ownership plan entity. The third-generation, family-run business said it has been working on transitioning to an ESOP-owned S Corp. structure since July 2010 effort to “find an ownership and liquidity succession plan that did not disrupt the culture…

Ten Steps to a Successful ESOP

Employee Stock Ownership Plans (“ESOPs”) are federally qualified employee benefit programs governed by U.S. law. Since our president and founder, John Menke, wrote some of the original ESOP legislation in 1974, more than 25 additional laws have been passed to promote and broaden the benefits of ESOPs. In general, ESOPs offer owners of companies tax…

ESOP Companies Report Positive 2010 Even Amid Slow Economic Recovery

WASHINGTON, Sept. 14, 2011 /PRNewswire-USNewswire/ — Results from the Employee Ownership Foundation’s 20th Annual Economic Performance Survey of ESOP (employee stock ownership plan) companies that are members of The ESOP Association show that ESOPs, while not immune to economic developments beyond their control, have seen an upturn over the past year. The survey shows ESOP…

Stock Distributions – An Occasional Trap for the Unwary

Distributions from an ESOP in the form of shares of company stock have many advantages. One of the compelling reasons for making distribution in the form of company stock, for example, is that distributions in the form of company stock enable participants to have a portion of their distribution taxed at long term capital gains…

The Joys Of An ESOP

NOVEMBER 1, 2004 The following article was originally published in Bloomberg Businessweek and written by Amey Stone Employee ownership can be a powerful tool Last November the 100 employees of Superior Plumbing & Heating, a mechanical contractor in Anchorage, Alaska, gathered on the snow-covered ground to celebrate their new status as full owners of the…

The Will-Burt Company Celebrates its 25th Anniversary as an Employee Owned Company

For additional information, contact: Angie Lamielle, Senior Marketing Associate 330-684-4002 alamielle@willburt.com For Immediate Release: Monday, June 06, 2011 The Will-Burt Company is celebrating its 25th year as an Employee Owned Company. Will-Burt employees have been participating in the Employee Stock Ownership Program (ESOP) since its inception on December 31, 1985. Will-Burt will be holding a…

The Perfect Solution to the Perfect Storm: How an SR ESOP Can Be Used to Save Your Business from Bankruptcy

A “perfect storm” has hit the U.S. economy and its privately-held businesses. Consumer purchasing power has dried up, resulting in reduced revenues for almost all privately-held businesses. At the same time most banks have stopped or curtailed lending, and bank credit is no longer available to many businesses. During the past two quarters many businesses…

Options for Mature ESOPs

Background One of the concerns that arises in the case of a company that is 100% owned by its ESOP (or where an ESOP owns less than 100% of the outstanding stock, all of the stock held by the ESOP is allocated, and the ESOP will not be acquiring any additional stock) is that once…

Four Ways That a Cash Flow ESOP Can Be Used To Help Your Company Survive the Credit Crunch

A “perfect storm” has hit the U. S. economy and its privately-held businesses. Consumer purchasing power has dried up, resulting in reduced revenues for almost all privately-held businesses. At the same time most banks have stopped or curtailed lending, and bank credit is no longer available to many businesses.

ESOP Marketability Discounts: Is the "Put Option" Argument Fallacious?

Virtually every ESOP appraisal that has been written in the past 10 years has concluded that, both in the case of purchases of company stock by an ESOP from direct shareholders and in the case of subsequent distributions and repurchases of company stock to and from plan participants, the discount for lack of marketability is…

Why Selling to an ESOP May Be Better Than an Internal Ownership Transition or Sale to a Third Party

By: John D. Menke There are good reasons to consider selling your firm to your own employees through an Employee Stock Ownership Plan (ESOP). No other alternative combines maximum financial advantage with the flexibility that enables you to customize the sale to fit your own particular circumstances. An ESOP enables you to sell your business…

ESOPs for Construction Firms, Contractors, and Subcontractors

This is a one-hour webinar about Employee Stock Ownership Plans for Construction Firms, Contractors, and Subcontractors.

WinSystems, an Employee-Owned Corporation on Youtube

Here is a video posted by one of The Menke Group’s Clients: WinSystems, an embedded PC designer and manufacturer, provides a high level of quality and customer service through an Employee Stock Ownership Plan (ESOP). This leads to employees holding a direct stake in maintaining a high level of customer service. Here is the full…

ESOP plans let founders cash out and employees cash in

By Nancy Mann Jackson, contributing writer June 17, 2010: 4:45 AM ET (CNNMoney.com) — On his 81st birthday, entrepreneur Bob Moore signed the papers to hand nearly a third of his company over to his 200 employees. But it’s a gift Moore and his three partners hope will pay off for them as well: By…

S Corporation Rules Involving Section 409(p)

Section 409(P) of the Code, which was enacted as part of the Economic Growth and Tax Relief reconciliation Act of 2001, sets forth anti-abuse rules for ESOPs that are maintained by S corporations. The following is to summarize the restrictions of Section 409(P), as follows: Basic Rule: No assets of an ESOP may be allocated…

Exit Strategies

The exit strategies available to owners of electrical wholesaling firms are somewhat limited. The available strategies include selling the business to a competitor, selling the business to the management employees, or selling the business to all of its employees under the provisions of an Employee Stock Ownership Plan (“ESOP”).

22 ESOP Myths And Misconceptions

Click here to download the full article in pdf format ESOPs were first authorized by federal legislation in 1974. Since that date, there have been more than 25 separate pieces of legislation that have further defined what an ESOP is and what an ESOP is permitted to do. Despite this fact, there are more misconceptions…

ESOPs: Uses, Advantages, and Illustrative Case Histories

USES OF AN ESOP A Readily Available Market for Controlling Shareholders Frequently, controlling shareholders desire to sell a part of their shares in order to diversity their holdings, or to provide liquidity for investment or estate planning purposes. Usually, however, there is no market for the sale of a minority interest in a closely-held company.…

ESOPS vs. Profit Sharing Plans

WHAT IS AN ESOP? The best way to explain an ESOP is to compare it to a profit sharing plan. ESOPs can do all the things a profit sharing plan can do. However, ESOPs can do a great many things that profit sharing plans cannot do. Profit sharing plans are regarded primarily as employee benefit…

ESOP: A New Tax Savings Tool for Owners of S Corporations

“A new dawn greets ESOP companies!” “The Holy Grail of business opportunities beckons: ESOP companies can now operate tax free!” Not since 1984, when the §1042 tax-free rollover was enacted, has the ESOP community bubbled with such enthusiasm. Under the provisions of the Economic Growth and Tax Relief Reconciliation Act of 2001, (“EGTRRA”), the ESOP’s…

ESOPS and Employee Productivity

USING ESOPS TO IMPROVE EMPLOYEE PRODUCTIVITY You’ve read about them—companies that seem to have found the key to success in an unstable business environment: “Sales Jump 312% as Employees Learn Rules of the Game” at Springfield Remanufacturing Corporation in Missouri. Management Accounting. Inc. magazine awards its Entrepreneur of the Year award to all 240 owner-employees of…

The ESOP Association 2009 Year-End Legislative Update

S. 1612 – The ESOP Promotion and Improvement Act of 2009: On August 6, 2009, Senator Blanche L. Lincoln (D-AR) introduced S. 1612, the ESOP Promotion and Improvement Act of 2009. The legislation has four sections, including an entirely new proposal to remove a 35 year bias against ESOP companies by the Small Business Administration.…

ESOPs as Retirement Benefits: An Analysis of DOL Data

Fall 2010 Written by Loren Rogers In a project funded by the Employee Ownership Foundation, the NCEO did an extensive analysis of ESOP companies using data from the US Department of Labor. Unlike prior research, the study carefully compiled data from multiple plans within a single company and used multiple years of data for each…

The ESOP Association and the Employee Ownership Foundation Release Results of the 2010 ESOP Company Survey

August 11, 2010 The ESOP Association and the Employee Ownership Foundation released today the results of a survey conducted among the Association’s 1,400 corporate members in the first quarter of 2010 which confirms positive benchmarks for ESOP (employee stock ownership plan) companies. The company survey is conducted every five years and was last completed in…

Ross Group Inc. Rewards Employees With Stock Ownership Plan

Ross Group Inc of Dayton, Ohio announced that the company has formed an Employee Stock Ownership Plan (ESOP) and has joined the growing list of companies whose employees are stockholders. “When the transaction is completed,” said Mr. Mark Ross, President and CEO, “the employees of Ross Group Inc will own just under 25 percent of…

Clif Bar Announces ESOP Program

Wednesday, June 30, 2010 Clif Bar & Company announced the selling of family owned common stock to its employees through an employee stock ownership plan (ESOP). Employees through the ESOP own 20% of the company, while husband and wife owners Gary Erickson and Kit Crawford retain the remaining 80%. No change in management structure will…

PRESS RELEASE – Technomics, Inc. Benefits Employees with Stock Ownership Plan

FOR IMMEDIATE RELEASE Technomics, Inc. Benefits Employees with Stock Ownership Plan Arlington, VA – January 26, 2010 Rick Collins, President and CEO of Technomics, proudly informed employees on January 26, 2010 that the Company formed an Employee Stock Ownership Plan (ESOP) and, in doing so, has joined the growing list of companies whose employees are…

RESILIENCE AND RETIREMENT SECURITY: Performance of S-ESOP Firms in the Recession

Written by Phillip Swagel and Robert Carroll Executive Summary A study of a cross-section of Subchapter S firms with an Employee Stock Ownership Plan shows that S-ESOP companies performed better in 2008 compared to non-S-ESOP firms along a number of dimensions, including job creation, revenue growth, and providing for workers’ retirement security. The S-ESOPs paid their workers higher…

ESOP: Employee Ownership of Companies on the Rise

The ESOP – Employee Stock Ownership Plan – is, slowly, on the rise. These worker-owned businesses are more productive and could benefit the American economy. Shoppers eye goods at the bakery of King Arthur Flour Co. in Norwich, Vt. The employee-owned firm was able to expand from its niche to deliver a broad product line.…

ESOPs on the Rise Among Small Businesses

Small companies are rushing to reward workers with employee stock ownership plans as low valuations make awarding shares more attractive By Karen E. Klein Bob Moore gathered three employee shifts together last month for pizza parties to celebrate his 81st birthday. But Moore, the founder and president of Bob’s Red Mill Natural Foods in Portland, Ore., also…

New Study Documents ESOP Account Balances

The NCEO has just completed an analysis of Form 5500 retirement plan filings filed by ESOP companies. The Form 5500 data are prone to considerable reporting and transcription error and should be used with caution, but many of the results described below are in accord with prior research, with our experience, and with best estimates…

An Open Letter to Business Owners

Dear Business Owner, Would you be interested in selling part or all of your stock in your company if you could sell it for more than twice what it is currently worth? Case Study I: The Benefits of a Gradual Sale to an ESOP We recently helped one of our clients do just that. Company X…

Why Should You Consider an ESOP?

Dear Reader: As president of Menke & Associates, Inc., I believe there is significant untapped growth potential in most privately held companies. Whether you want to sell some or all of your stock in the company in the next five years or whether you plan to remain active for the long term, Menke & Associates,…

The Origin and History of the ESOP and Its Future Role as a Business Succession Tool

The First ESOP (1956) San Francisco lawyer and economist Louis O. Kelso created the first employee stock ownership plan (ESOP) in 1956 as a way to transition ownership of Peninsula Newspapers, Inc. from its two founders (both then in their 80s) to their chosen successors, the managers and employees. Kelso had long believed that the…

Tax Alert for Business Owners

Dear Business Owner, This may be the opportune time to take action to avoid the increase in capital gains tax rates that will take effect after 2010. As you may know, the Bush tax rate cuts, including the current 15% capital gains tax rate, are slated to expire at the end of 2010. In addition,…

New Law on S-ESOP Prohibited Allocations

MEMORANDUM From: Legal Department Date: January 2008 Subject: Prohibited Allocations in S Corp ESOPs Section 409(p) of the Code, which was enacted as part of the Economic Growth and Tax Relief Reconciliation Act of 2001, sets forth anti-abuse rules for ESOPs that are maintained by S corporations. The following is to summarize the restrictions of Section…

Highlights Of The Pension Protection Act Of 2006

I. PROVISIONS AFFECTING ESOPS S Corp UBIT Exemption The unrelated business income tax (“UBIT”) exemption that currently applies to S corporation ESOPs, together with the related §409(p) anti-abuse provisions, have been made permanent. These provisions were scheduled to expire at the end of 2010. As the result of PPA, these provisions have been made permanent,…

Highlights of EGTRRA 2001

I. INCREASES IN CONTRIBUTION, DEDUCTION AND BENEFIT LIMITS Contribution Deduction Limits. The limit on an employer’s deduction for contributions to a non-leveraged ESOP or a profit sharing plan is increased from 15% to 25% of participants’ aggregate compensation. 401(k) deferrals are not counted for purposes of the deduction limits. However, 401(k) deferrals will be included…

Economic Growth and Tax Relief Reconciliation Act of 2001

Comparison of Old and New Provisions Current Law New Law (EGTRRA) I. Increases in Contribution, Deduction and Benefit Limits Contribution Deduction Limits: An employer’s deduction for contributions (including 401(k) deferral contributions) to a profit sharing or stock bonus plan is limited to 15% of participants’ taxable compensation. The money purchase plan limit is 25%. The 15%…

New "Required Minimum Distribution" Rules

MEMORANDUM TO: ALL CLIENTS FROM: MENKE & ASSOCIATES, INC. LEGAL DEPARTMENT DATE: JULY 18, 2001 SUBJECT: NEW “REQUIRED MINIMUM DISTRIBUTION” RULES Depending on the terms of your Plan, participants who are age 70½ or older, are generally required to receive a distribution from the Plan every year. We will refer to this type of a distribution…

New Requirement on Fidelity Bonding for Qualified Employee Benefit Plans

MEMORANDUM TO: ALL CLIENTS FROM: LEGAL DEPARTMENT DATE: JULY 18, 2001 RE: NEW REQUIREMENTS ON FIDELITY BONDING FOR QUALIFIED EMPLOYEE BENEFIT PLANS I. BACKGROUND Current regulations under ERISA require generally that all Employee Benefit Plans engage an Independent Qualified Public Accountant ( IQPA) to perform an annual audit of the Plan, and to include that…

A Modest Proposal for a New, New Deal

Capitalism collapsed in the fall of 2008. It’s collapse was also the direct result of a flaw in the system. Capitalism promised universal opportunity and a rising tide for everyone. To achieve this result, capitalism privatized and/or deregulated every possible industry. It glorified greed, extravagant executive compensation, and financial manipulation. Just as in the case…

ESOP Pros and Cons