“The evidence continues to show that employee-owned businesses and their employees are faring better than most, positioning them to better withstand the challenges of a volatile economy,” said Stephanie Silverman, president and CEO of the ESCA. “As business leaders prepare for possible economic uncertainty ahead, ESOP-owned private firms offer a compelling model for positioning workers and companies alike.”

The study, conducted by the National Center for Employee Ownership (NCEO), collected insights from more than 100 ESOP-owned companies, representing a cross-section of the market. The median age of the respondents’ ESOP is 21 years; the median number of employees is 525 and 49% of the companies have $200 million or less in revenue while 51% have more than $200 million. For most of these ESOPs (85%), no ESOP account holds more than 5% of the shares.

The study underscores how employee-owned companies experience better business outcomes and has implications for business leaders who are seeking stability and resilience in our volatile economy.

Exceptional Employee Retention

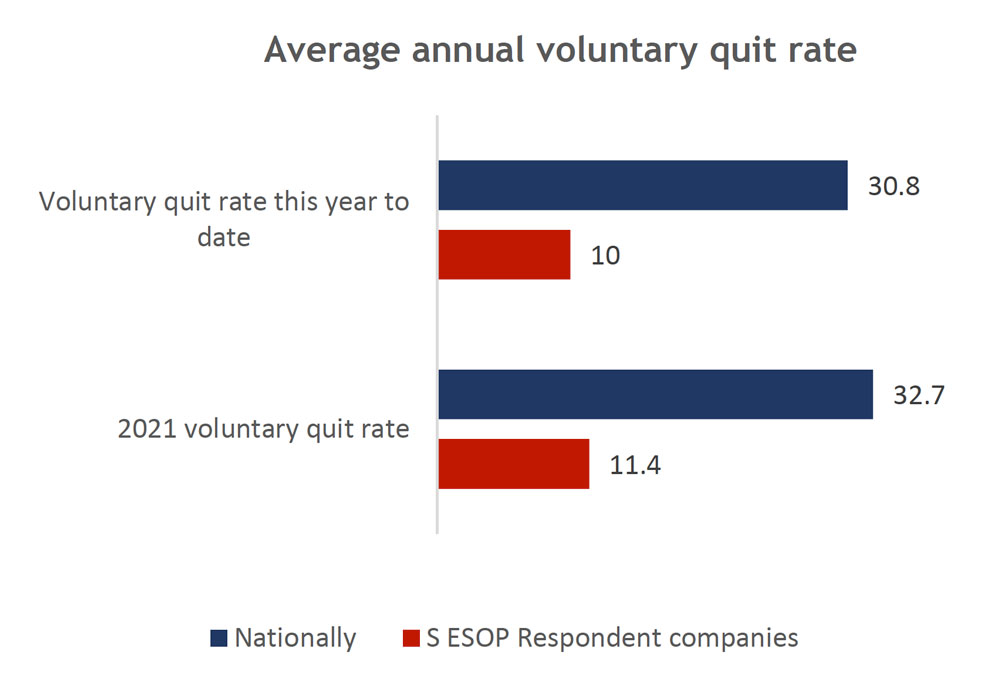

In a time when businesses nationwide struggle with recruiting and retaining talent, ESOP-owned S corporations demonstrate employee retention rates that are higher than national averages.

Voluntary quit rates among ESOP companies are approximately one-third of the national average.

Almost 80% of ESOP-owned S corporation leaders believe that their employee-owned structure gives them a competitive edge in retaining top talent. This isn’t merely a coincidence; it underscores the strength of a corporate culture rooted in shared ownership and a sense of belonging.

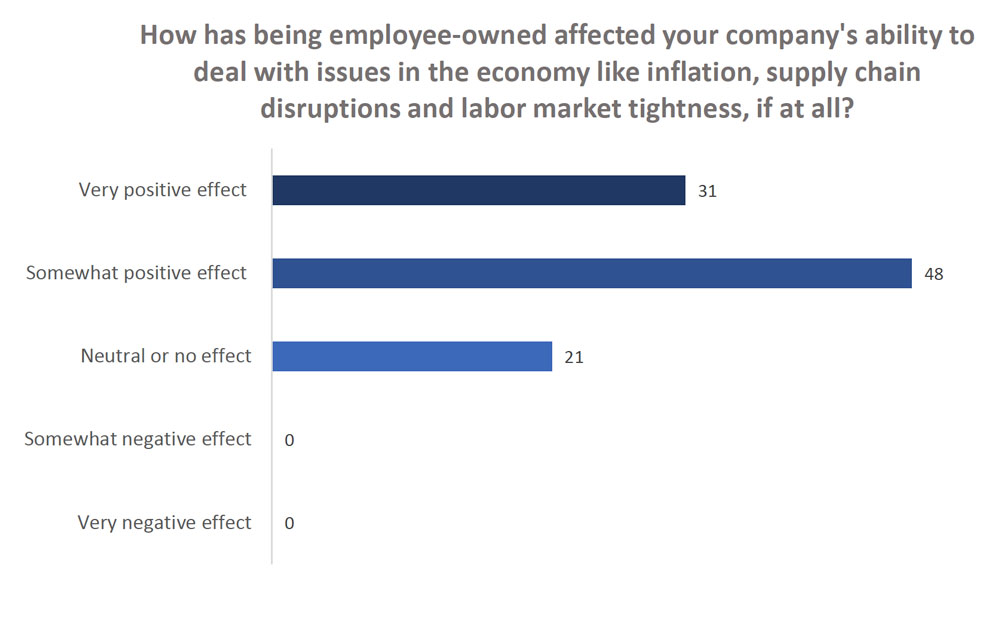

Resilience Amid Economic Disruptions

ESOP-owned companies exhibit resilience when navigating economic disruptions. Layoffs among employee-owners are a fraction of the national average. Furthermore, nearly 80% of these corporations believe that employee ownership equips them with the tools to better manage economic challenges.

This resilience is a testament to the fact that when employees have a stake in the success of the company, their commitment and adaptability in the face of adversity become invaluable assets.

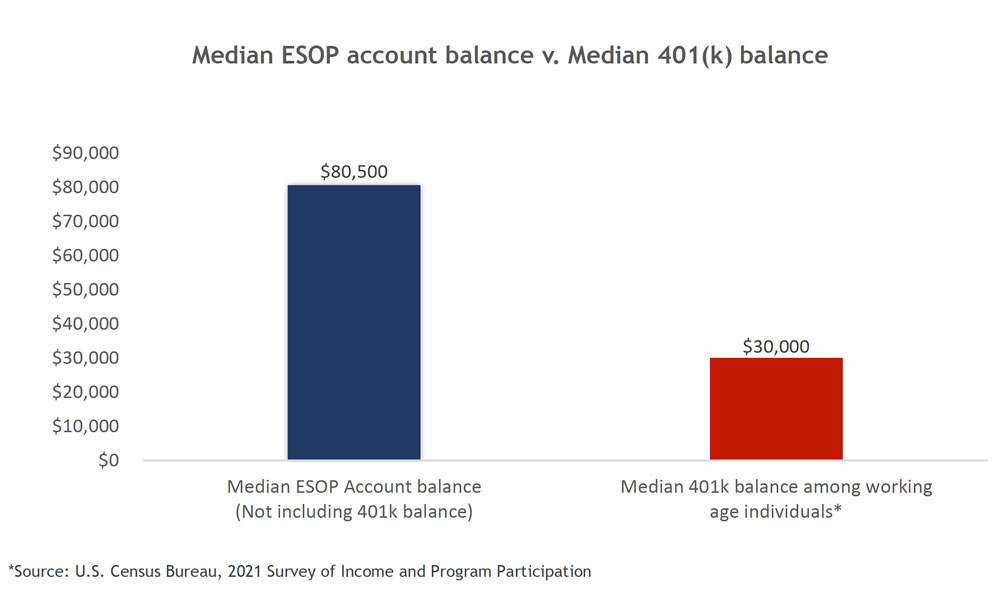

Enhanced Retirement Security

An important finding of the NCEO study is the superior retirement security enjoyed by employees of ESOP-owned companies. The median ESOP account balance for participants is estimated at $80,500, which doesn’t account for other retirement savings vehicles such as 401(k)s. This financial cushion can significantly bolster the retirement prospects of these workers, setting them apart from many Americans who grapple with inadequate savings for their golden years.

The study highlights the importance of recent legislation introduced in the US Congress.The Promotion and Expansion of Private Employee Ownership Act of 2023 was introduced in the summer of 2023 and enjoys bipartisan support in both the House and Senate.The Employee Equity Investment Act was introduced earlier this year, also with bipartisan, bicameral support. The 2023 Omnibus Bill, which funded the Federal Government, included two new pieces of legislation to spur ESOP adoption and was signed into law at the end of 2022.

Federal agencies have been active in encouraging employee ownership. Both the Department of Labor and the Small Business Adminstration have rolled out new rules or clarified existing rules to support employee ownership. All of this activity, along with the findings of the NCEO study commissioned by the ESCA, underscores the enduring benefits of employee ownership in enhancing retirement security, promoting employee retention, and bolstering resilience in the face of economic uncertainty.

As business leaders contemplate strategies to navigate an increasingly volatile economic landscape, the ESOP model emerges as a compelling choice, one that places both workers and companies in a stronger position to face the challenges that lie ahead. The Menke team is optimistic that all this activity will help to unleash a new decade of ESOP adoption and further unlock the transformative power of employee ownership.