Employee Stock Ownership Plans (“ESOPs”) are federally qualified employee benefit programs governed by U.S. law. Since our president and founder, John Menke, wrote some of the original ESOP legislation in 1974, more than 25 additional laws have been passed to promote and broaden the benefits of ESOPs.

In general, ESOPs offer owners of companies tax efficient means to sell all or part of their shares to their employees, on a timeline of their choosing. ESOPs have the added benefit of energizing employees to increase sales and profits as these employees become “owners.” Shares sold to an ESOP are held in a trust: the employees receive beneficial ownership, while and in most instances the selling shareholder retains control. The formation of an ESOP does not preclude the company from going public or being sold at a later date. Below are ten steps to understanding, designing and implementing an ESOP that is right for your company.

| Step 1 | Get sound advice |

| Step 2 | Meet minimum requirements |

| Step 3 | Understand ESOP structures |

| Step 4 | Understand ESOP benefits and potential pitfalls |

| Step 5 | Compare your change of ownership alternatives |

| Step 6 | Collect & provide information for feasibility study |

| Step 7 | Receive & review proposed ESOP structure & valuation |

| Step 8 | Document, finance & execute ESOP |

| Step 9 | Communicate ESOP benefits to employees |

| Step 10 | Administer ESOP |

Step 1 – Get sound advice

Although the ESOP concept may be straight forward, there are dozens of variations in the initial set-up: including leverage vs. no leverage financing, prefunding, share sale schedule, C corporation versus S corporation election, employee eligibility and participation, vesting schedules, and share repurchase details. Therefore, it is imperative to understand which combination of options works best for your situation. Receiving advice from experts will save time, cost less and results in the right plan structure. Menke & Associates welcomes the opportunity to advise you on these decisions.

About The Menke Group

- Only full service firm – Structuring, legal & tax compliance, valuation, documentation, debt capital raising (if needed), employee communication, administration – FULL ACCOUNTABILITY FROM BEGINNING TO END

- Oldest ESOP advisor – Menke (an ESOP-owned firm), was founded in 1974. 2005 marks our 31st anniversary!

- Most active ESOP advisor – Since 1974, approximately 20,000 private-company ESOPs have been created. Menke has structured over 2,000, the most by any single organization. Please see our reference list.

- Largest ESOP advisor – 75 expert advisors, lawyers, accountants and plan administrators to create and administer the right plan for you and your company. Meet our professionals in our pamphlet ESOP Advisors and Bankers.

- Largest regional firm – 6 offices throughout the United States.

- Largest ESOP administrator – nearly 1,000 active clients.

Step 2 – Meet minimum requirements

Although ESOPs work well with a wide variety of shareholder liquidity situations, there are certain minimum requirements to qualify. An average-sized company starting an ESOP has 75 employees, but we have structured many ESOPs with as few as 10 employees and as many as 25,000 employees. ESOPs are popular for both public and private companies in almost all industries. Over the last several years, the breakdown of completed ESOPs by industry was approximately 30% services, 20% manufacturing, 20% construction, 15% financial and insurance, and 15% distributors.

Answer the following questions to see if your company qualifies:

| Yes | No | Issue |

| [ ] | [ ] | Does one or more major shareholder desire to sell all or part of their company shares now or over the next five years? |

| [ ] | [ ] | Does your company have greater than $1 million in revenues? |

| [ ] | [ ] | Does your company have more than 10 employees? |

| [ ] | [ ] | Is your company profitable? |

| [ ] | [ ] | Are your normalized pretax earnings greater than $200,000? |

| [ ] | [ ] | Is your company a corporation (either S or C)? |

| [ ] | [ ] | Is your business in any industry other than professional services (doctors, dentists, lawyers)? (However, some states do allow ESOPs for professional services; ask us which ones). |

If you have answered “yes” to most of these questions, then an ESOP may work

for you.

Step 3 – Understand ESOP structures

ESOPs offer the owners of companies a tax-efficient means to sell all or part of their ownership stakes on a timeline of their choosing, or allow companies to issue new shares to employees to promote increased productivity. The most basic ESOP plan includes:

|

1. |

Appraisal – Company receives independent appraisal to help determine desired schedule of selling shares (e.g., sell all now, sell over a period of years, prefund ESOP now and sell shares later) | |

|

2. |

ESOP trust established – selling shareholder(s) sell all or part of their holdings to the ESOP trust, or the company issues new shares to ESOP trust | |

|

3a. |

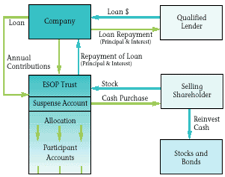

Leveraged ESOP – A leveraged ESOP uses outside financing or a seller note to acquire shares from the selling shareholder(s). The shares are allocated to each participant’s (eligible employee) account as the loan is repaid. During this repayment, the shares are released from a special ESOP account, called a “suspense account,” to the ESOP participants’ accounts according to formulas developed by the IRS.The corporate advantages of a leveraged ESOP are that it creates tax advantaged financing for purchasing capital goods, for expanding by acquisitions, or simply by increasing capital. For whatever purpose, the principal borrowed and interest to buy the stock is fully tax deductible! | |

Setting up an ESOP

Annual Administration

|

|

|

|

3b. |

Non-Leveraged ESOP– selling shareholder(s)This type of ESOP acquires the stock of selling shareholder(s) from cash contributed directly from the company. Additional shares can be purchased in future years as cash flow permits. The company could also prefund the ESOP Trust by making contributions for several years and then acquiring shares at a future date (and presumably at a higher price).Using this non-leveraged ESOP will avoid the impact of debt on the company’s value and balance sheet, while still receiving the tax deductibility of the cash contributions at the time of the contribution (making prefunding attractive). | |

|

3c. |

Non-leveraged ESOP – no selling shareholders(s)This ESOP is one of the best plans for gradual accumulation of retirement benefits tied to the value of employer stock and for promoting participatory management structures. It is funded by contributions from the company of newly issued shares. These shares are fully tax deductible at their appraised fair market value as of the date of contribution, reducing taxes and improving cash flow. Clearly, in this case the side effect is near-term dilution. | |

|

4. |

Dividends – Should the company pay dividends to the ESOP shares to either help pay down any ESOP loan or to pass through to the beneficial shareholders, these dividends would also be tax deductible. | |

|

5. |

§1042 roll-over treatment (C corp. only) – If the ESOP meets the threshold of holding 30% of the outstanding shares, the selling shareholder may reinvest those proceeds in qualified assets and defer capital gains taxes (potentially indefinitely). | |

|

6. |

S Corporations– When combined with ESOPs, S corporations create a powerful tool for income tax deferral and capital accumulation within a business. S corps. Are not subject to corporate level income tax; instead, income is passed through to the shareholders, who then individually pay tax on that income. Since ESOPs are tax-exempt, to the extent that income from the S corp. is passed through to an ESOP as a single shareholder, that income escapes current income taxation at the personal level also. A 100% ESOP-owned S corp. pays NO corporate taxes.If the company is an S corp. at the time of the selling shareholder(s) transaction, the shareholder(s) cannot take advantage of §1042 treatment. However, a C corp. can set up an ESOP and take advantage of §1042 treatment and shortly thereafter convert to S corp. status to escape current income taxation. | |

|

7. |

Control – Contrary to the name and common belief, employees do not own the company in an ESOP arrangement. The ESOP trust holds the company stock in the eligible employees’ names without any direct investment on the part of the employee. The ESOP separates control of the stock from the financial benefit of ownership. A board-appointed trustee (usually the founder, president or majority shareholder) retains voting control for most instances. Regardless, 30 years of data consistently show that employee “ownership” through an ESOP trust increases sales and profitability! | |

|

8. |

Participation & Allocations – ESOP shares are allocated according to payroll of the current employees, providing a broad base of properly incentivized employees. Certain employees can be excluded from the plan, for example, part-time employees, those under 21 years old, and unionized employees. | |

|

9. |

Vesting – Within certain mandated guidelines, owners decide the rules for eligibility and vesting of the ESOP shares. | |

|

10. |

Liquidity – The employee-participant cannot individually sell their shares at any time. The ESOP usually buys back the shares, over a period of time, as vested employees leave or retire. This allows for a smooth transition of ownership from retiring workers to new employees. | |

|

11. |

Supplemental Plans – A Supplemental Executive Retirement Plan (“SERP”) can be designed to provide highly compensated employees with retirement benefits that would otherwise be capped or limited under ESOP regulations. For more detail, please see our report Supplemental Executive Retirement Plans. | |

|

12. |

Management Stock Bonus Plans (“MSBP”) – These plans may be used to enhance executive management’s compensation through the issuance of restricted shares based on performance. | |

|

13. |

Disclosure – each year the company is required to disclose to the ESOP participants certain information. This information is limited to the number of beneficial shares held, the value of each share and any cash in the account. The Company is NOT required to disclose any of the company’s detailed financial information. | |

For a more detailed discussion of how ESOPs work, read our brochures ESOP Uses, Advantages – Illustrative Case Studies and ESOPs vs. Profit Sharing Plans.

Step 4 – Understand ESOP benefits & potential pitfalls

There is no such thing as a free lunch – but ESOPs come pretty close!

| For the owner/selling shareholder(s) | |

| + | Liquidity and diversification of personal wealth without giving up control! |

| + | Sold shares minimize estate tax liability with capital gains tax deferred indefinitely (C corporation selling >30%, §1042 tax free rollover) |

| + | Option to sell shares over time to benefit from future increasing share price |

| + | Retain control, remaining ownership, title and associated benefits |

| + | ESOP does not preclude sale or IPO of entire company at a later date |

| + | FAST and PREDICTABLE! 100% probability of success |

| + | Liquidity event for one partner without payments from remaining shareholders |

| + | Possible premium price received for selling control |

| – | Fiduciary responsibility of ESOP trustee |

| – | Possible discount price for retaining control |

| For your company | |

| + | Attract, motivate and retain quality employees |

| + | Supplemental benefit plans still available for key employees |

| + | Increase productivity through employee ownership |

| + | Reduce corporate taxes |

| + | Increase company cash flow |

| + | Company retains its independence and identity |

| + | S corporation – shares owned by ESOP pay no corporate or personal taxes! |

| + | No disruption to customer relationships |

| + | Elegant way to spin off a business line without selling to a competitor |

| + | Management attention not averted for extended period |

| + | Can replace an existing Profit Sharing Plan with much greater benefits to your company (see report ESOPs vs. Profit Sharing Plans) |

| – | Initially increased leverage or shareholder dilution |

| For your employees | |

| + | Beneficial company ownership! Increase retirement nest egg |

| + | Increase retirement nest egg – studies show employees of ESOP-owned companies have 2.5x the retirement funds of non-ESOP employees!!!! |

| + | Promotes smooth management succession |

| + | Direct, long-term incentive to promote company growth and profitability |

| + | Provides future market for company shares |

| + | Employees are not threatened by potential sale |

| – | Family members, if also employees, may not be able to participate in ESOP |

For a more thorough discussion, read our brochure ESOPs – Pros & Cons.

Step 5 – Compare your change of ownership alternatives

The flexibility of ESOP structures satisfies a wide range of company owner initiatives versus other change of ownership options.

Change of ownership method |

||||||

| External methods “sell out” | Internal methods “sell in” | |||||

| Corporate Sale | IPO | Stock Redemption | Key Employee Plan | ESOP | ESOP + Key EE plan | |

| Min. size of company | small | large | small | small | small | small |

| Ability to sell shares now | yes | no | yes | no | yes | yes |

| Partial sale option | no | yes | yes | no | yes | yes |

| Probability of success | medium | low | high | high | high | high |

| Remain independent | no | yes | yes | yes | yes | yes |

| Tax deferred proceeds | no (unless merger) | no | no | no | yes | yes-C Corpno- S Corp(yes with seller note) |

| Tax deductible contributions | NA | NA | no | no | yes | yes |

| Maintain control | no | public scrutiny | no | yes | yes | yes |

| Employee security | low | high | high | high | high | high |

| Promote productivity | no | no | no | yes | yes | yes |

| Key employee incentive | depends on buyer | usually | no | yes | usually | yes |

| Time to completion | 6-12 months | 6-12 months | 2 weeks | 2 weeks | 2-6 weeks | 2-6 weeks |

| Fees | large | large | small | small | small | small |

Step 6 – Collect & provide information for feasibility study

If you have made it this far and have yet to talk to a Menke advisor, we suggest a call to allow us to answer any questions you may have, as well as review some information so that we may provide preliminary thoughts on how an ESOP may work for you.

In order to fully analyze whether an ESOP can be beneficial for your company and its employees, it is critical to first identify the objectives of all those involved. There are often overlapping and conflicting objectives. For example, the company’s expansion objectives may compete with the objectives of the potential selling shareholders, which both require cash from the company to fund. Furthermore, the impact of an ESOP on the employees and the ability to motivate employees must be seriously considered.

In preparation for this discussion, please fill in our Confidential ESOP Feasibility Questionnaire. You may either fax us the completed questionnaire before the call, or walk us through it during the call. All information you provide is held in the strictest of confidence.

Step 7 – Receive & review proposal for ESOP & valuation

The most critical part of the ESOP plan is the financial structure. If the plan is not properly structured, the seller and company may lose out on thousands or even millions of dollars of financial benefits. There are many creative structures to maximize ESOP benefits that experienced ESOP advisors can design.

After collecting the necessary information from Step 6, your Menke advisor will review with you how an ESOP may work for your company and, if appropriate, provide a written proposal outlining:

Proposal Proposed ESOP structure Proposal Preliminary valuation Proposal Execution plan Proposal Timing Proposal Fees

If the proposed structure and independent appraisal is acceptable, you are ready to execute your new ESOP plan. Menke & Associates is available to assist in the explanation of the proposed ESOP structure to any of the constituencies that may be involved (i.e., shareholders, directors, company counsel, auditors and lenders)

Menke has an independent affiliate company, Sansome Street Appraisers, who specializes in ESOP valuations and would welcome the opportunity to work with you. Sansome Street completes over 1,000 appraisals each year for our clients.

Your Menke advisor would then meet with you to review and help select all the various options available for the ESOP. Menke has qualified over 2,000 ESOPs with the IRS. Each of our plans is individually designed to reflect the goals and objectives of the company and the selling shareholder(s). Menke has a thorough knowledge regarding which options should be included in the ESOP plan (our checklist is 27 pages long), and which benefit plans should be combined for maximum financial advantage.

Step 8 – Document, finance & execute ESOP

While an ESOP transaction is straightforward from a tax standpoint, the proper documentation to assure these tax advantages is highly technical. This complexity makes it prudent for your company to hire an ESOP professional. Menke & Associates is the most experienced ESOP advisor in the country.

Our documentation is the culmination of more than 30 years of experience in creating over 2,000 ESOP plans. This history and our in-house legal team allows us to provide state-of-the-art documentation at rates a fraction of what they would cost if created from scratch. Our plan documentation has passed the scrutiny of hundreds of lawyers, accountants and IRS reviewers. Since Menke plays an active role in drafting new ESOP legislation, we understand immediately the impact and required changes to ESOP structures and documentation from new legislation.

Menke would provide all of the legal documentation necessary to design and install an ESOP, including:

| Documents | ESOP plan |

| Documents | Corporate resolutions |

| Documents | Opinion letters |

| Documents | Employee announcements |

| Documents | IRS application for a Determination Letter (We work directly with the IRS on your behalf in connection with obtaining IRS approval) |

If requested, we also assist in the structuring and funding of any leveraged ESOP. Raising ESOP financing presents issues and opportunities not present in ordinary financing situations. For example, if an ESOP transaction is properly structured and presented, the borrower will usually be able to obtain better terms than with a conventional loan. Because Menke specializes in obtaining ESOP loans, we know how to best describe and present an ESOP loan, as well as which bank lenders would be most interested.

Step 9 – Communicate ESOP benefits to employees

The ultimate success of your ESOP will depend to a degree upon how well the benefits of the plan are communicated to the participants. Numerous studies consistently show that in those companies where management had taken a direct and active role in informing the employee-participants of their importance and influence on corporate profits, and how those profits related to the increasing price of their shares, there was a measurable improvement in productivity, turnover, absenteeism and efficiency. The latest study, conducted by Rutgers University in 2000 of over 680 companies, showed that sales growth per employee per year grew 2.3% more for ESOP companies vs. comparable non-ESOP companies.

Menke & Associates has developed a successful program of communicating the ESOP benefits to employees. This is accomplished in two phases.

| Phase I |

| The 1st phase is an employee meeting. One of our ESOP specialists would lead the meeting, beginning with a custom presentation, and ending with a Q&A session so that potentially confusing technicalities, such as eligibility and allocation, can be explained thoroughly and accurately. The remainder of the meeting would be conducted by management, and concentrate on explaining the meaning of profitability and how that directly affects the value of the company’s share value.For this meeting Menke prepares and provides various materials, including explanations of the background and philosophy of ESOPs, the plan description and technical aspects. Menke’s experienced communications professionals will also prepare and provide the presentation. |

| Phase II |

| The 2nd phase involves the distribution of the annual ESOP benefit statement to the employee-participants. Menke has designed a facsimile stock certificate that clearly states the value of each account. |

In addition, since ESOPs have been around for more than 30 years, an entire industry has been formed to help implement ESOPs through communication programs geared towards all employees. The ESOP Association hosts annual conferences and offers publications and products to help educate employees how to maximize the benefits of their ESOP through increased productivity. More than 11,000 U.S. companies are currently reaping the benefits of an ESOP program.

For a more thorough discussion, read our brochure ESOPs & Employee Productivity.

Step 10 – Administer the ESOP

Annual ESOP administration is more complex than pension and profit sharing administration. The complexities inherent in ESOP record keeping include:

| Record keeping | Compliance with IRS rules & annual filing |

| Record keeping | Compliance with Department of Labor rules |

| Record keeping | Tracking the individual cost basis of each share of allocated stock |

| Record keeping | Determining share allocation & release in a leveraged ESOP |

| Record keeping | Determining the alternative tax consequences upon distribution |

| Record keeping | Converting “Other Investment Account” cash to stock upon purchase of seller’s stock |

| Record keeping | Converting “Other Investment Account” cash to stock upon repurchase from terminated or retired participants |

| Record keeping | Allocating stock or cash dividends on a pro rata basis to all participants |

| Record keeping | Adjusting the cost basis for forfeited stock when reallocated |

| Record keeping | Completing the letters of transfer upon distribution |

| Record keeping | Converting the company stock to an interest bearing account for any terminated participant not paid off |

Menke & Associates specializes in the installation and recordkeeping of ESOPs throughout the United States. We have developed our own specialized computer programs to accommodate the complex accounting that is required in administering ESOPs and have the largest in-house staff of legal, financial, actuarial, recordkeeping and programming specialists.

In addition, in the course of installing over 2,000 ESOP plans, we have encountered and resolved every possible legal, tax and ERISA issue that can be encountered. Accordingly, we can answer all your questions on the spot without having to resort to time-consuming and costly research. We look forward to working with you.