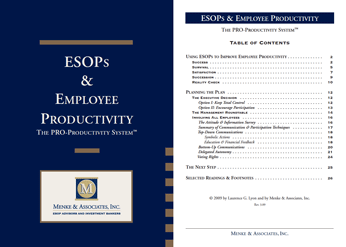

Why Selling to an ESOP May Be Better Than an Internal Ownership Transition or Sale to a Third Party

By: John D. Menke There are good reasons to consider selling your firm to your own employees through an Employee Stock Ownership Plan (ESOP). No other alternative combines maximum financial advantage with the flexibility that enables you to customize the sale to fit your own particular circumstances. An ESOP enables you to sell your business…

View detals